Supplier performance management is fast becoming a core competence in successful organisations. Ensuring compliance at supplier onboarding is not enough. What performance management is really about is the ongoing development and monitoring of key suppliers to derive as much value as possible from contracts. Businesses must look at more than squeezing these suppliers on price. Value can include operational efficiencies, reduction of the risk of supply chain disruptions, improved product or service quality, and enhanced customer satisfaction.

Some key suppliers are vital to your business and need a higher level of engagement. By segmenting suppliers, using pre-agreed criteria, we can apply the appropriate level of attention needed to ensure that they deliver to our requirements. Focusing on the most important suppliers creates a competitive advantage for your business.

What is involved in supplier performance evaluation?

The criteria used to evaluate suppliers may be based both on data (quantitative) and on subjective (qualitative) measures.

- Quantitative supplier performance measures for the supply of goods can include compliance with regulations, on-time deliveries vs late deliveries, or % of deliveries rejected due to damage or quality issues. For services, this may involve not meeting milestones or failing to achieve pre-defined goals.

- Qualitative criteria are less clear-cut. These involve tracking responsiveness, flexibility, and cooperation, especially when solving problems and conflicts. Both types of criteria together contribute to overall procurement, and therefore the company, performance.

How to develop a supplier performance management process?

Segment your suppliers

The number of active suppliers in most organizations means that it is challenging, if not impossible, to effectively monitor them all. Segmenting suppliers in a way that highlights those that are strategic allows you to actively track their performance. There is no one perfect way to segment suppliers, choose a method that works for you. The most common method is the A – B – C grouping where suppliers are segmented depending on their importance to the business:

- Strategic: High value, low volume and sole-source. Potential partners, alliances and sole-source vendors fall into this smallest group. These suppliers may make up 5% -10% of the total company spend so are vital to your business operations.

- Important: Mid-value, there are alternative sources of supply, These suppliers are those that are required to allow your company run on an everyday basis. It would be inconvenient or stressful to change. Risks are related mainly to quality, service and reputation.

- Tactical: Low value, high volume, lots of supply options This is the largest group of suppliers (up to 80%) that make up the “tail-end” of your third-party expenditure. They supply easily replaceable commodities or services and the risk level is low

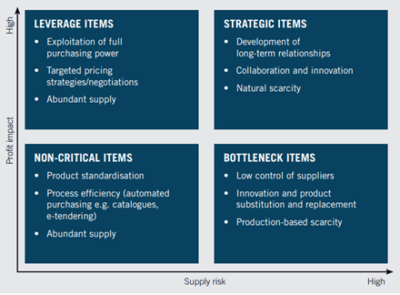

Larger organizations with big supply bases and mature supplier relationship management (SRM) programs might use the Kraljic Matrix. The model, designed by Peter Kraljic in 1983, considers the importance of risk and the profit impact on the business and is one of the tried-and-tested ways to accurately segment vendors. It requires considerable resources and is best applied using automated tools.

The main objective of supplier performance management is to achieve the highest level of reliability, quality and performance from key suppliers while limiting risk.

Gather the data

Assemble qualitative performance data from available sources such as stakeholder and end-user feedback and internal surveys. Factual quantitative data is drawn from analysing and understanding your third-party spend. Combining supplier performance data and feedback will identify areas for improvement, trends, and opportunities for innovation. Technology is the enabler here, a software solution can provide an efficient way of aggregating and interrogating lots of data while providing visibility and an audit trail.

Establish the performance measures

Supplier performance is usually measured on a scorecard using a series of agreed and contractual Key Performance Indicators (KPIs). Choose wisely and prioritise them based on their importance to your business. Here are some examples of measurable KPIs:

| KPI type | Products | Services |

|---|---|---|

| Quality | Rejects and operational failures | Resolution of service issues based on priority level |

| Compliance | Failure to meet regulatory requirements | Failure to meet pre-defined experience and qualifications levels for contracted staff |

| Delivery | Late delivery, breakages, loss in transit | System availability or uptime, not meeting project timelines, late completion |

| Customer support | Handling of complaints and escalation of issues, responsiveness, communication | |

| Innovation | Product design improvements, cost savings in materials | Proposals for project delivery improvements, speeding up delivery |

| Risk | Financial stability within stated parameters | Reputational risk of system failures and breaches of security |

Onboarding of newly contracted key suppliers is simplified using pre-defined KPIs. This sets the stage for developing and maintaining strong supplier relationships and managing poor performance when it occurs. One pitfall is choosing too many metrics to monitor. Drowning in the data is a real possibility.

The performance evaluation plan

Develop a plan that outlines the process for measuring and monitoring supplier performance against KPIs at pre-determined time intervals. This is a collaborative process that should involve all stakeholders, both in the development of the KPIs and the frequency of measurement. Stakeholders can include customers, finance, buyers, subject matter experts, and end users. More mature procurement teams that run supplier relationship management programs (SRM) routinely involve suppliers in setting the KPIs.

Monitoring supplier performance

Tracking supplier performance is a process, not an event. The aim is to identify issues before they become problems and have a remedial plan. Success is achieved when the evaluation process, criteria, and timing are known to all stakeholders and no one is surprised when the results are tabled. Improvements can only happen if evaluation reports are communicated to both parties and acted upon. Penalties may not be the best way to improve performance. They can work only if they are balanced with incentives that encourage innovation and continuous improvement when KPIs are met or exceeded.

The strength of collaboration

Feedback to suppliers must be communicated clearly and must be timely. Encourage open dialogue with suppliers by offering suggestions that help suppliers develop skills to improve performance. Some companies have a problem with working openly with suppliers thinking that sharing operational and financial information leaves them in a weaker negotiating position. The opposite may be the case. Sharing of new technologies and innovative ideas can lead to added value and cost savings for both parties. Inviting suppliers to actively participate in the evaluation process, by providing feedback on performance against goals builds trust. A best practice is to develop relationships at many levels, both corporate and operational, ensuring overall visibility into the supplier’s wider organization.

The power of technology

Monitoring performance is considerably easier using cloud-based software tools. Both the buyer and the supplier have the same visibility of the data, via an online portal. Data can be assembled seamlessly both from scheduled online questionnaires and spend history. Scorecards show the level of adherence to KPIs visually. Each authorized user can view the actual situation in real time. Auditable information forms the basis for meaningful discussions with suppliers.

The Oxalys Supplier Management solution guarantees effective supplier performance assessment. With our Supplier Performance Evaluation feature you can:

- Professionalise your supplier performance management

- Run periodic, effective and accurate evaluation

- Create customised performance surveys

- Gather relevant opinions across your organisation

- Develop improvement plans

Our software solution will automate and streamline your supplier performance processes. Create and customise a performance survey, set relevant criteria according to projects and markets, gather insightful feedback and scores, and suggest opportunities for improvement.